Hi, I haven't been on here for a while.. hope everybody in the community has been great since..

My question Is very specific and I haven't had to much success addressing this with the carrier.

I have a car rental agency and a rental car policy for my fleet, which also provided me with a rental car contract which I'm using between me and the renters of my cars in hopes that in case of a claim this contract provided by the insurance itself provides the best basis for a claim.

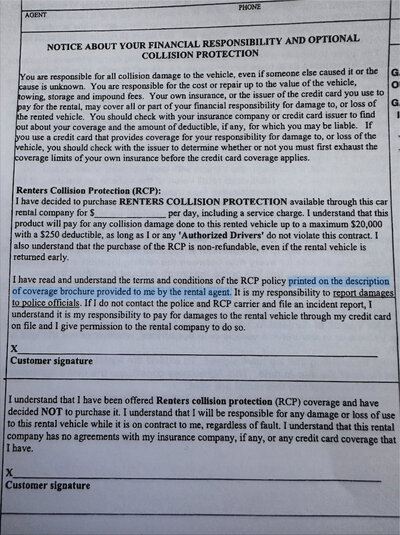

There is a section called " Notice About Your Financial Responsibility and Optional Collision Protection " which I attached here below.

The Renter hast the option to purchase Renters Collision Protection ( RCP) though me. ( I'm assuming this an option for me to sell the insurance coverage to the renter for a daily rate).

My question is, am I even legally authorized to sell / forward insurance or insurance coverage since I don't have a license and I'm must a rental car company ?

My question Is very specific and I haven't had to much success addressing this with the carrier.

I have a car rental agency and a rental car policy for my fleet, which also provided me with a rental car contract which I'm using between me and the renters of my cars in hopes that in case of a claim this contract provided by the insurance itself provides the best basis for a claim.

There is a section called " Notice About Your Financial Responsibility and Optional Collision Protection " which I attached here below.

The Renter hast the option to purchase Renters Collision Protection ( RCP) though me. ( I'm assuming this an option for me to sell the insurance coverage to the renter for a daily rate).

My question is, am I even legally authorized to sell / forward insurance or insurance coverage since I don't have a license and I'm must a rental car company ?