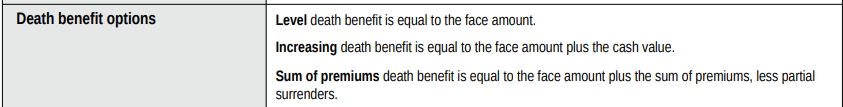

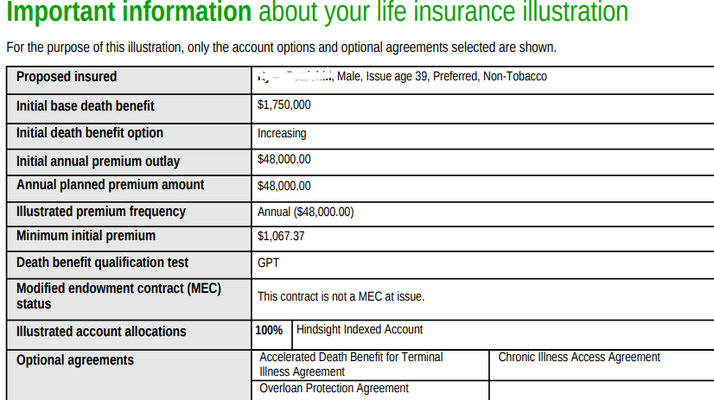

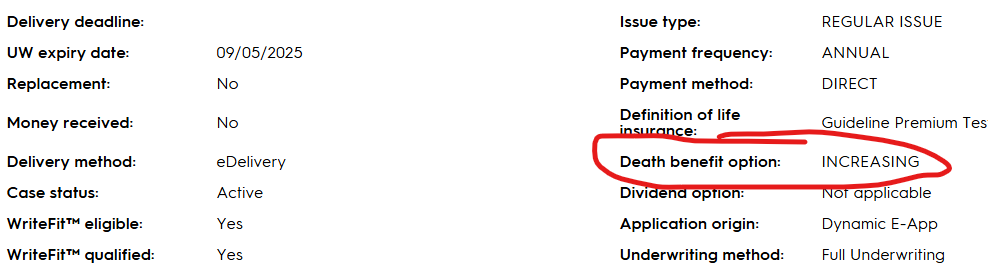

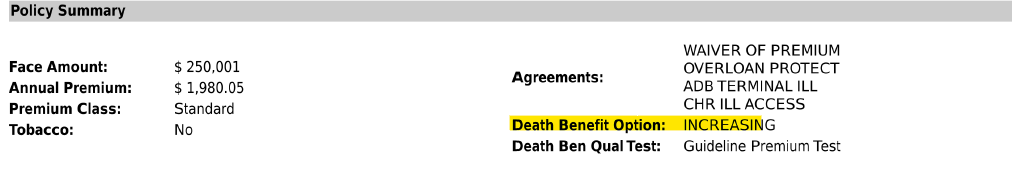

I was always told the cash value was the equity in the policy you don't add the cash value on top of the death benefit. But on IUL which I've never sold, I was told option B you get the death benefit and in addition you get the cash value on top of the death benefit.

Maybe I understood the person who told me this. Is it like a Prticipating WL where the DB is increasing which option B on a IUL is increasing . But they are not two separate buckets of money. The math wouldn't even make sense. Can someone clarify this with a simple explanation.

Maybe I understood the person who told me this. Is it like a Prticipating WL where the DB is increasing which option B on a IUL is increasing . But they are not two separate buckets of money. The math wouldn't even make sense. Can someone clarify this with a simple explanation.