romeroaaron

Expert

- 40

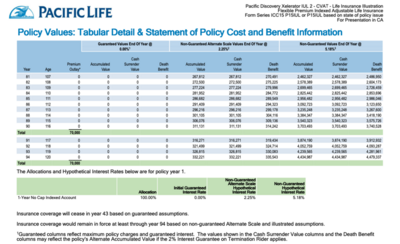

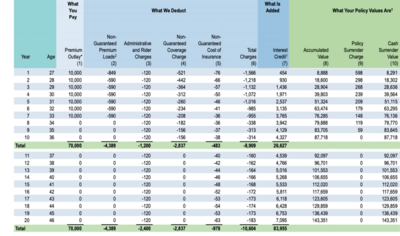

I watched this 21 episode playlist over the weekend which ended up being 4ish hours. There is some good information if you want to sell IULs, but man, there are some serious claims for this product. I've always seen IULs as something that can be used as a savings account that yields more interest than with a bank. As for Doug, he recommends to put the majority of your assets inside of a max funded IUL so that you can pull loans on it as your main form of untaxed income in retirement with the idea that, as the cash value compounds at the same interest rate the loan is at (zero wash), if you were to die, the cash value would pay the loans back and also leave the original cash value or MORE inside of the policy. A few things.

- The guaranteed interest from life insurance companies from the general account portfolio that is not linked to an index is usually 1-2.5% MAXIMUM. Meaning, if you were to pull out too hefty of a loan (10% like he recommended in the series) then the fees and low interest when the IUL is not indexed would eat up the cash value.

- He uses the example that if you average 10% in an IUL with $1M of cash value you should pull $100K in loans annually. This would be true if we averaged 10% but is there anyone who can consistently hit that goal? Especially when the market is down, the low interest from the general account portfolio would only make you $20K in a bad year. Worse yet, if you are linked in a down year, you made ZERO.

- Is it true that if you properly max fund an IUL the cost of insurance and fees is only about 1% of what the total cash value is? If so, then I would definitely start looking into properly linking and rebalancing to yield a good interest rate. Curious what you guys have to say.