- 570

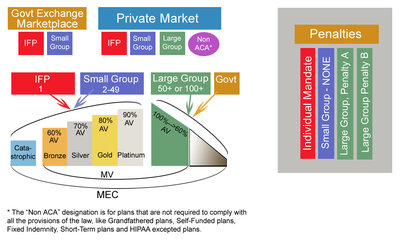

I know small group health plans will be adopting the medal standard. However, I have not seen anything in my area discussing if large group plans will also be required to follow the medal standard too? I mean groups of 51+ that curently are underwritten with different components that community rated small groups. Does anyone know if they will also have to choose from medal plans, or will they still have the flexibility tthey do now?

Thanks!

Thanks!