Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Infinite banking/ Be Your Own Bank

- Thread starter SamIam

- Start date

- 5,416

So, are you asking about a strategy where people, instead of making payments on existing debts of say 7-8% interest on those debts instead buy life insurance & pay premiums to the carrier to then take out more loans (from insurance carrier) to make payments to the existing lenders they already have?For those of you doing the infinite Banking/ be your own bank concepts for paying off debt, what income brackets are you usually targeting?

Share with me the secret math how this is better to take more loans after waiting many years to get to the point of having cash value built up in new policy.

I just struggle with how this is could be a positive strategy for the consumer when most policies take years to break even in the 1st place.

Only way this sale seems to work is if the consumer cant use a calculator, cant do math or doesnt understand money/interest or all of the above.

Now, if you are talking about a plan where someone buys life insurance & has it as an option in 10 or 20 years to take loans instead of acquiring more bank debt, I can see that as an option, just not following the idea of selling new life policy to use to pay off already existing debts

Last edited:

- 11,613

The math isn't hard, but I'm still not a fan.

The cost of delay in building wealth (regardless of where you accumulate it) is in the back-end. So if you took 5 years to pay down debt, that's 5 years taken off the back end of the growth you could've had assuming a fixed time horizon.

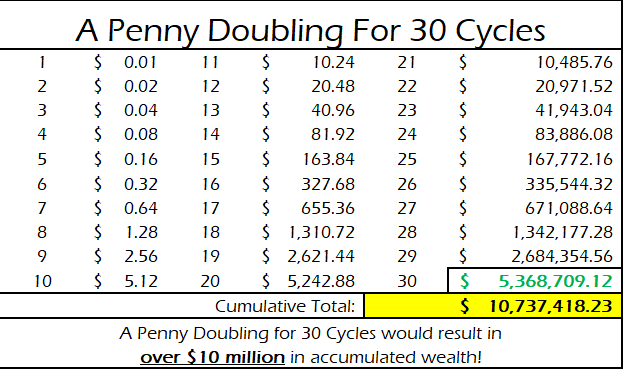

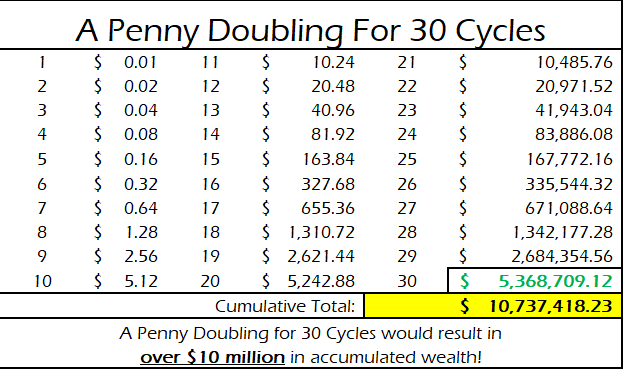

A penny doubling every day for 30 days, you have over $10 million total.

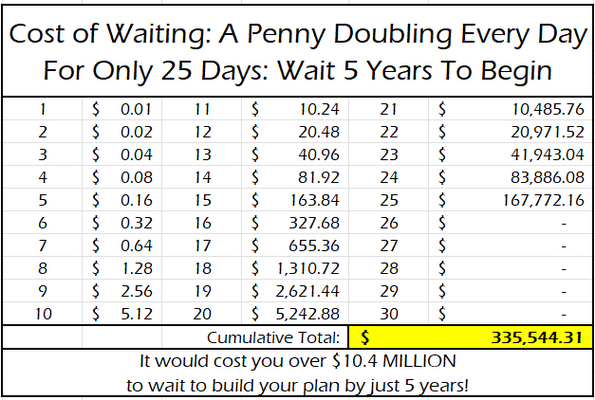

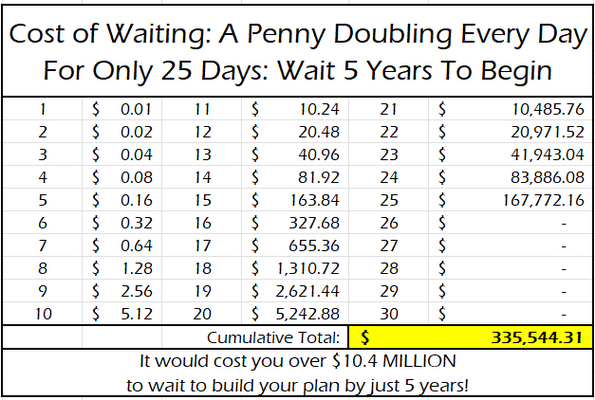

However, subtract out the last 5 days, and you don't have anywhere near the same amount of wealth:

That's the justification.

To me, I don't like it because you still juggle with the debt AND you're building a policy... and if something happens to your income... the client can really be screwed.

The cost of delay in building wealth (regardless of where you accumulate it) is in the back-end. So if you took 5 years to pay down debt, that's 5 years taken off the back end of the growth you could've had assuming a fixed time horizon.

A penny doubling every day for 30 days, you have over $10 million total.

However, subtract out the last 5 days, and you don't have anywhere near the same amount of wealth:

That's the justification.

To me, I don't like it because you still juggle with the debt AND you're building a policy... and if something happens to your income... the client can really be screwed.

- 11,190

There are probably over 10 different "infinite banking" concepts floating out there now. Each with its own twist.

The book "Becoming your Own Banker" by Nelson Nash. Was the original. And the first version published back in the 80s. He coined the term "infinite banking".

I met Nelson in person. Interesting guy.

However, the original concept never advocated using WL to pay off EXISTING debts.

That is 100% NOT the original concept.

The original concept is to use the policy for FUTURE loans.

Pay off current loans. By then the policy has enough cash to use it for new loans.

Old loans, helocs, 401Ks, entire paycheck, IUL..... Nelson would be turning over in his grave

The book "Becoming your Own Banker" by Nelson Nash. Was the original. And the first version published back in the 80s. He coined the term "infinite banking".

I met Nelson in person. Interesting guy.

However, the original concept never advocated using WL to pay off EXISTING debts.

That is 100% NOT the original concept.

The original concept is to use the policy for FUTURE loans.

Pay off current loans. By then the policy has enough cash to use it for new loans.

Old loans, helocs, 401Ks, entire paycheck, IUL..... Nelson would be turning over in his grave

- 5,416

Plus. Life insurance isn't making a daily return of 100% like a penny doubling every day 365 days a year. Anyone using such an example in a life insurance or even retirement savings discussion is misleadingThe math isn't hard, but I'm still not a fan.

The cost of delay in building wealth (regardless of where you accumulate it) is in the back-end. So if you took 5 years to pay down debt, that's 5 years taken off the back end of the growth you could've had assuming a fixed time horizon.

A penny doubling every day for 30 days, you have over $10 million total.

View attachment 19142

However, subtract out the last 5 days, and you don't have anywhere near the same amount of wealth:

View attachment 19143

That's the justification.

To me, I don't like it because you still juggle with the debt AND you're building a policy... and if something happens to your income... the client can really be screwed.

- 11,613

No one does. I use that as a calculation example, not an example of performance of any kind.

There are probably over 10 different "infinite banking" concepts floating out there now. Each with its own twist.

The book "Becoming your Own Banker" by Nelson Nash. Was the original. And the first version published back in the 80s. He coined the term "infinite banking".

I met Nelson in person. Interesting guy.

However, the original concept never advocated using WL to pay off EXISTING debts.

That is 100% NOT the original concept.

The original concept is to use the policy for FUTURE loans.

Pay off current loans. By then the policy has enough cash to use it for new loans.

Old loans, helocs, 401Ks, entire paycheck, IUL..... Nelson would be turning over in his grave

@scagnt83 - I'm a Medicare guy, mainly, with good income, no debt other than mortgage (& some rentals, but they all cashflow) interested in WL for myself.

I read Nash's book about a decade ago. It somewhat made sense. Some Ohio National guys also talked about it quite a bit back then (I lived in Columbus at the time). I never bit the bullet because I basically didn't have good income. So I just have a term.

Anyway, which carrier or carriers are currently more whole life focused and potentially a good place to go to to do a "classic" (not heloc or full paycheck or whatever) IBC policy? Or what IMO/FMO might help with things like this?

My thinking is it can be a good place to grow savings, maybe eventually use it as a bank-like resource... But need to run illustrations etc.

- 11,190

@scagnt83 - I'm a Medicare guy, mainly, with good income, no debt other than mortgage (& some rentals, but they all cashflow) interested in WL for myself.

I read Nash's book about a decade ago. It somewhat made sense. Some Ohio National guys also talked about it quite a bit back then (I lived in Columbus at the time). I never bit the bullet because I basically didn't have good income. So I just have a term.

Anyway, which carrier or carriers are currently more whole life focused and potentially a good place to go to to do a "classic" (not heloc or full paycheck or whatever) IBC policy? Or what IMO/FMO might help with things like this?

My thinking is it can be a good place to grow savings, maybe eventually use it as a bank-like resource... But need to run illustrations etc.

Guardian, Mass, New York Life, Northwestern Mutual, Penn Mutual, Ameritas. In that order.

I sent you a PM

- 2,634

Yes Please.Share with me the secret math how this is better to take more loans after waiting many years to get to the point of having cash value built up in new policy.

Because it mostly cant. At least for the typical american consumer.I just struggle with how this is could be a positive strategy for the consumer when most policies take years to break even in the 1st place

Thats the best way of putting it I have ever heard.Only way this sale seems to work is if the consumer cant use a calculator, cant do math or doesnt understand money/interest or all of the above.

Guess why they call it 'Infinite Banking'?

- 11,190

To expand on that...

Ameritas has the lowest dividend history and not the best cash growth in comparison.

Penn Mutual has really strong illustrations... but their financials are not nearly as strong as the big 4. For a while, their life unit was paying more in dividends than they were earning in premium.... not a healthy sign.

Guardian, Mass, NYL, & NWM are independently rated to be the absolute safest financial institutions in the US.

Very strong and very long Dividend histories. Very similar policy options and performance.

NWM is 100% captive.

NYL is mostly captive, you need the right connection or large enough premium to write them as an indy.

That leaves Guardian and Mass for the independent agent.

Cant go wrong with either option.

Guardian allows Loan flexibility that Mass does not.

Mass offers greater PUA flexibility long term vs. Guardian.

Guardian has more accommodating underwriting vs. Mass. Especially for build, smokeless tobacco, cannabis, & sub-standard health conditions.

Ameritas has the lowest dividend history and not the best cash growth in comparison.

Penn Mutual has really strong illustrations... but their financials are not nearly as strong as the big 4. For a while, their life unit was paying more in dividends than they were earning in premium.... not a healthy sign.

Guardian, Mass, NYL, & NWM are independently rated to be the absolute safest financial institutions in the US.

Very strong and very long Dividend histories. Very similar policy options and performance.

NWM is 100% captive.

NYL is mostly captive, you need the right connection or large enough premium to write them as an indy.

That leaves Guardian and Mass for the independent agent.

Cant go wrong with either option.

Guardian allows Loan flexibility that Mass does not.

Mass offers greater PUA flexibility long term vs. Guardian.

Guardian has more accommodating underwriting vs. Mass. Especially for build, smokeless tobacco, cannabis, & sub-standard health conditions.