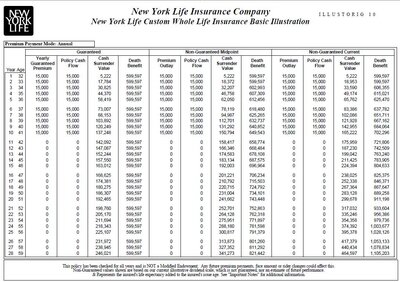

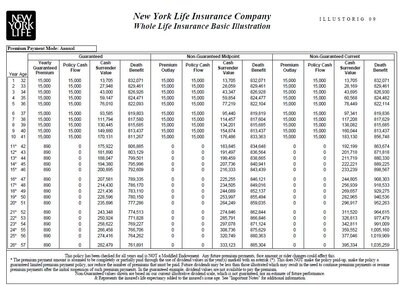

I reviewed a policy illustration from a NY Life agent recently. It is a 10 year pay custom whole life policy. What I found out is the cash value (net of premium) grows by 4.6% from year 9 to year 10, but grows by 6.5% in year 11 and continue to grow at this level for 10 years (under the current dividend assumption). Under the guaranteed column, the CV grows by 3.5%.

It seems the policy has some kind of enhancement in dividend treatment or CV growth I am not aware of right after year 10 (the policy paid-up date). Did anybody compete with the CWL policy before and know the reason?

It seems the policy has some kind of enhancement in dividend treatment or CV growth I am not aware of right after year 10 (the policy paid-up date). Did anybody compete with the CWL policy before and know the reason?