Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

What's the math formula to calculate IRR for ROP Term?

- Thread starter ManyLeads

- Start date

Carrier quotes for ROP normally do this for you.Can someone breakdown how to do the math to show the IRR on ROP for me? I'm a bit rusty with my math! Thank you in advance.

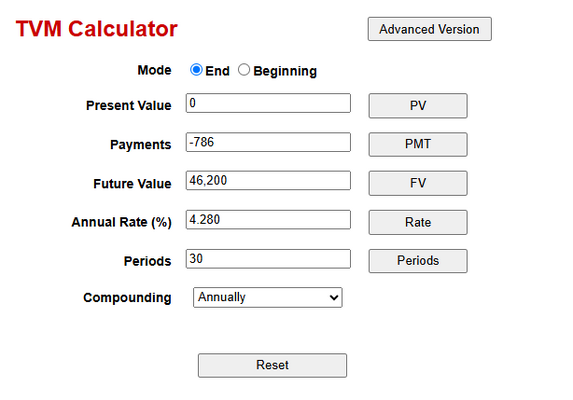

However, take the non-ROP cost and subtract it from the ROP cost. Take that result and dump it into a TVM calculator and use 0 as the present value, negative whatever that difference is, future value is the returned premiums, years are the term, and solve for rate.

So, for a 30yo male PfNT, Banner is 754/mo for 30 year term. Assurity is 1540. The difference between the two is: 1540-754=786. Total ROP is: 1540x30=46200.

Your calculation will look like this:

Which is the tax-free rate or return needed to eclipse the ROP had you invested the difference.

Hope that helps.

- Thread starter

- #3

- Thread starter

- #5

- 26,797

What that Guru T-Ray said. Just a note: the ROP is Guaranteed per the illustration.

Very little. 5-7%?Awesome! Who are your favorite carriers to write ROP with? Also, what percentage of your sales does ROP make up?

ROP is niche and I really pick and choose who I present it to.

That said, I like Cincinnati life for ROP. Assurity has a product as well. There just aren't a lot of ROP options.

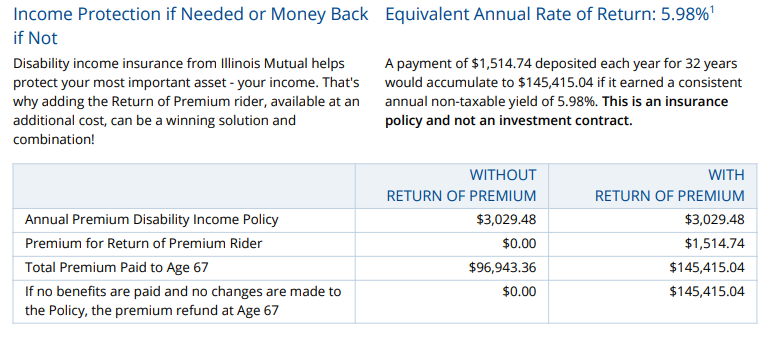

For disability, Illinois Mutual.

Similar threads

- Replies

- 10

- Views

- 611

- Replies

- 7

- Views

- 536