Well, I wasn't going to reply to this thread anymore because I had forgotten how time consuming these things are but if this will benefit the forum here it goes - my last reply:

You are a rock star and you can do math as well... NICE!. 100K a month is new business.. damn, you need to teach me your ways.

Actually Scooter33 the best way to learn is before opening your agency go to work for a large agency where the agency is breathing down your neck everyday to produce and that should do the trick.

If you can write 100K of new business a month. I'm telling you, where I am. The carriers will be begging to give you an appointment.

I wish this was the case in Florida.

Well, I'm glad SIAA has worked out for you. It's not for me. I have spoken w/ dozens of other agency owners that are part of SIAA and they are all on the same page as I am.

Well Scooter33, when you posted on an open internet forum calling out an organization a "SCAM" you did expect people to chime in right? So you are posting your experience and I am posting mine.

FLins: im assuming this is all business you are doing personaly, not including any producers under you, correct? Sounds pretty incredible. Are you doing mostly commercial to hit 100k new business every month (plus servicing your existing book)? Or what percent of this is commercial and what is personal lines?

What strategy are you using to keep your service so efficiently low to not need to hire a CSR? Are you using a service center? I would love to better understand how to make these kinds of sales PLUS service such a large book efficiently all at the same time. Because just doing this high number of new sales volume alone, takes immense time in consultations and analysis with the prospects, let alone the actual binding, processing, and review of the policies once issued. So then you have the service piece of the existing book added on top, which I'd love to hear more. My experience - even so called " low maintenance clients" who don't pay cash (previously mentioned in your post) and do full pay, have umbrellas etc, can require quite a bit of service work such as; Mortage changes and certs for refinances, new cars, change of adress (and needing home policy rewrites), new jewelry for floaters, new investment property purchase (or change of policy from rented to vacant) etc. and thats if they don't ever have any claims, potential claims questions, or coverage questions (like if they go on vacation and want to know if they should buy rental car coverage as one example). Plus, for your existing book, wouldn't you also need time to watch their renewals and make sure their carrier is still the best fit / most competitive every now and then (I came from captive background so that was at least one thing we couldn't do, so saved time there)? I'm not questioning what you say is true at all. I just really want to know so I can be a better agent and more efficient myself once my IA starts! I'd greatly appreciate some more insight into your previous and current operations!

Roxiepup you seem like a good guy. Obviously I am not going to post my techniques that took me years to develop on an open forum but if you would like to know what I am doing send me a PM and we can speak on the phone and I would be happy to give you a few pointers.

You know he is smoking crack? No one man shop can do 100k a month in new business, while serving, marketing, running the business, etc. I bet he has a 12" dick, looks like Brad Pitt and plays the piano like Billy Joel.

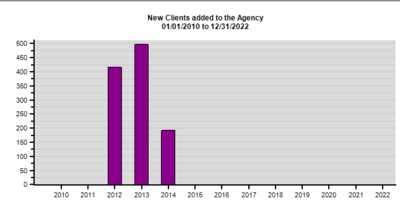

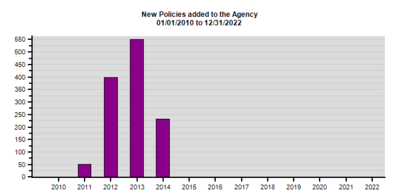

Nope, don't smoke, don't drink nor do drugs. And actually my average per month is right around 80k or around 45 new policies (please see attachments below). Some months I do pass that 100k barrier but I am ok with 80K of new business for now.

Also related to my previous post, I'm still bashing my head in trying to figure out how it is possible to not only produce 100k/month, but ALSO service your own book with no CSR help (I think you said your book was currently about 2 M in 1.5 yrs, and obvious growing), AND run the agency (accounting / books, marketing developement, education, etc? The only way I can fathom this possible is if the bulk of the premium is commercial vs personal lines. With new business sales at 100k/month, is think you'd be so busy just from that, how would you respond to the service requests your agency is going to be getting - many who need quick action, or at least same day. What is your attrition? If the larger agencies really expect that sort of growth AND service a large book....are the even looking at or measuring quality of service...or was it all about sell, sell, sell? I guess I am still a newer kid on the block than I thought after 8 yrs being in this biz. Still learning, and still taking classes!

You are a smart man Roxiepup, see earlier post reply.

Unless he is mostly large commercial....

Actually up until 3 years or so ago my entire background was strictly in commercial lines but because it is so easy building a BOB of personal lines I figure I would focus on personal lines for now and build an income then go after what I know best which is commercial and this plan has worked nicely I must say.

Not possible to do 100k a month with personal lines and small commercial.

I do agree hitting 100K every month of personal lines can be a little bit difficult but not impossible. That is why I am ok with hitting 80K per month of new premium.

Now if you have a staff of 2-4 people... Maybe be possible. But according to him, he is doing all himself.

Yes, so far no CSR. A CSR will only be hired upon me reaching 3 million BOB.

Great thing about the internet. You can say anything you want! Hey ladies, give me a call and I will fly you to the moon in my private space ship.

Another great thing about the internet too is one can post screenshots backing up their claims. I must say though, as much as I love you Scooter33 I am not doing this for you, I am doing this so others reading this thread can come to their own conclusion including my SIAA experience.

Please see attached screenshots below. Since opening my agency 12/14/2011 my average is 45 new policies per month or 3 per day. There have been some crazy months such as January 2013 where I wrote 80 policies but that is not realistic or sustainable - yet. As they say, pictures and numbers don't lie right.

I don't have a CSR yet nor will hire one until my BOB reaches 3 million, period and end of story and recommend you do the same.

So boys (and girls) this will wrap up my participation on this forum for a while because these forums can be time consuming. If anyone (not located in Florida of course) wants to know my setup send me a PM and I would be happy to coach you on a Saturday morning or something.

Take care.

You are a rock star and you can do math as well... NICE!. 100K a month is new business.. damn, you need to teach me your ways.

Actually Scooter33 the best way to learn is before opening your agency go to work for a large agency where the agency is breathing down your neck everyday to produce and that should do the trick.

If you can write 100K of new business a month. I'm telling you, where I am. The carriers will be begging to give you an appointment.

I wish this was the case in Florida.

Well, I'm glad SIAA has worked out for you. It's not for me. I have spoken w/ dozens of other agency owners that are part of SIAA and they are all on the same page as I am.

Well Scooter33, when you posted on an open internet forum calling out an organization a "SCAM" you did expect people to chime in right? So you are posting your experience and I am posting mine.

FLins: im assuming this is all business you are doing personaly, not including any producers under you, correct? Sounds pretty incredible. Are you doing mostly commercial to hit 100k new business every month (plus servicing your existing book)? Or what percent of this is commercial and what is personal lines?

What strategy are you using to keep your service so efficiently low to not need to hire a CSR? Are you using a service center? I would love to better understand how to make these kinds of sales PLUS service such a large book efficiently all at the same time. Because just doing this high number of new sales volume alone, takes immense time in consultations and analysis with the prospects, let alone the actual binding, processing, and review of the policies once issued. So then you have the service piece of the existing book added on top, which I'd love to hear more. My experience - even so called " low maintenance clients" who don't pay cash (previously mentioned in your post) and do full pay, have umbrellas etc, can require quite a bit of service work such as; Mortage changes and certs for refinances, new cars, change of adress (and needing home policy rewrites), new jewelry for floaters, new investment property purchase (or change of policy from rented to vacant) etc. and thats if they don't ever have any claims, potential claims questions, or coverage questions (like if they go on vacation and want to know if they should buy rental car coverage as one example). Plus, for your existing book, wouldn't you also need time to watch their renewals and make sure their carrier is still the best fit / most competitive every now and then (I came from captive background so that was at least one thing we couldn't do, so saved time there)? I'm not questioning what you say is true at all. I just really want to know so I can be a better agent and more efficient myself once my IA starts! I'd greatly appreciate some more insight into your previous and current operations!

Roxiepup you seem like a good guy. Obviously I am not going to post my techniques that took me years to develop on an open forum but if you would like to know what I am doing send me a PM and we can speak on the phone and I would be happy to give you a few pointers.

You know he is smoking crack? No one man shop can do 100k a month in new business, while serving, marketing, running the business, etc. I bet he has a 12" dick, looks like Brad Pitt and plays the piano like Billy Joel.

Nope, don't smoke, don't drink nor do drugs. And actually my average per month is right around 80k or around 45 new policies (please see attachments below). Some months I do pass that 100k barrier but I am ok with 80K of new business for now.

Also related to my previous post, I'm still bashing my head in trying to figure out how it is possible to not only produce 100k/month, but ALSO service your own book with no CSR help (I think you said your book was currently about 2 M in 1.5 yrs, and obvious growing), AND run the agency (accounting / books, marketing developement, education, etc? The only way I can fathom this possible is if the bulk of the premium is commercial vs personal lines. With new business sales at 100k/month, is think you'd be so busy just from that, how would you respond to the service requests your agency is going to be getting - many who need quick action, or at least same day. What is your attrition? If the larger agencies really expect that sort of growth AND service a large book....are the even looking at or measuring quality of service...or was it all about sell, sell, sell? I guess I am still a newer kid on the block than I thought after 8 yrs being in this biz. Still learning, and still taking classes!

You are a smart man Roxiepup, see earlier post reply.

Unless he is mostly large commercial....

Actually up until 3 years or so ago my entire background was strictly in commercial lines but because it is so easy building a BOB of personal lines I figure I would focus on personal lines for now and build an income then go after what I know best which is commercial and this plan has worked nicely I must say.

Not possible to do 100k a month with personal lines and small commercial.

I do agree hitting 100K every month of personal lines can be a little bit difficult but not impossible. That is why I am ok with hitting 80K per month of new premium.

Now if you have a staff of 2-4 people... Maybe be possible. But according to him, he is doing all himself.

Yes, so far no CSR. A CSR will only be hired upon me reaching 3 million BOB.

Great thing about the internet. You can say anything you want! Hey ladies, give me a call and I will fly you to the moon in my private space ship.

Another great thing about the internet too is one can post screenshots backing up their claims. I must say though, as much as I love you Scooter33 I am not doing this for you, I am doing this so others reading this thread can come to their own conclusion including my SIAA experience.

Please see attached screenshots below. Since opening my agency 12/14/2011 my average is 45 new policies per month or 3 per day. There have been some crazy months such as January 2013 where I wrote 80 policies but that is not realistic or sustainable - yet. As they say, pictures and numbers don't lie right.

I don't have a CSR yet nor will hire one until my BOB reaches 3 million, period and end of story and recommend you do the same.

So boys (and girls) this will wrap up my participation on this forum for a while because these forums can be time consuming. If anyone (not located in Florida of course) wants to know my setup send me a PM and I would be happy to coach you on a Saturday morning or something.

Take care.

Attachments

Last edited:

And having those things, can also stimulate creativity, helping to catapult your business to a level where you make more money, despite the fact you may be "splitting" more - no?

And having those things, can also stimulate creativity, helping to catapult your business to a level where you make more money, despite the fact you may be "splitting" more - no?  , I'd love to hear about it. And or any last minute things for me regarding the contract that I may want to watch out for and or edit, I'd love to get that too - please feel free to PM. Thanks guys!!!

, I'd love to hear about it. And or any last minute things for me regarding the contract that I may want to watch out for and or edit, I'd love to get that too - please feel free to PM. Thanks guys!!!