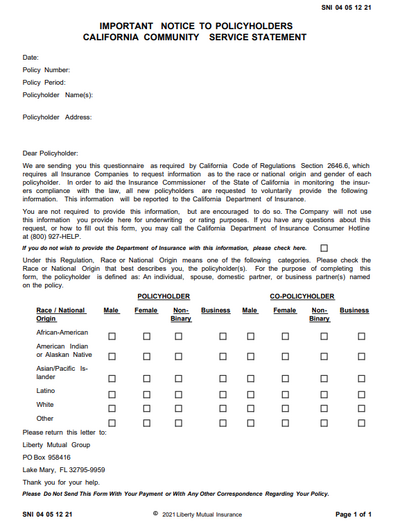

I ran across a policy with this today, and oh man, California Code of Regulations §2646.6, great.

So, let me get this straight—you California agents are all over this, right? @Markthebroker , @marindependent , You're totally backing up the Insurance Commissioner, making sure everyone knows exactly how he's saving the world, right? Because nothing screams progress like having to identify underserved communities based on whether or not they check all the right boxes: higher uninsured rates? Check. Lower per capita income? Check. Predominately minority? Double check. Feels good, doesn't it?

I know all your white clients are just lining up, ready to share their race, national origin, and gender with you. I'm sure that's a super easy conversation: 'Hey, Mr. Smith, real quick, before we finalize this renewal, can you tell me what box you tick for ethnicity? It's for, uh, compliance reasons.'

And don't forget guys! You've gotta make sure the Commissioner's got all the ammo they need when they come back to check if those underserved communities are really getting the service they deserve. Heaven forbid one ZIP code doesn't get enough love—they'll send the compliance brigade down to 'intervene.' Maybe open a service office next to a Starbucks, call it a day.

But don't worry, all this race and demographic data? Strictly for 'monitoring.' They're definitely not using it for pricing or underwriting decisions—because, y'know, California's all about fairness.

So, how are you guys handling it? Got your policyholders sending in their demographic info in droves?

We all need to promote equitable access, for the good of the Californian community.

Last edited: