- 7,400

I don't think David McKnight brings up the asset protection that could be offered for long term care risk by a Partnership LTC insurance policy for those with enough money to pay the premiums.

That seems to me to be a more efficacious solution than hoping that four years of life insurance withdrawals will be an adequate solution for a LTC need.

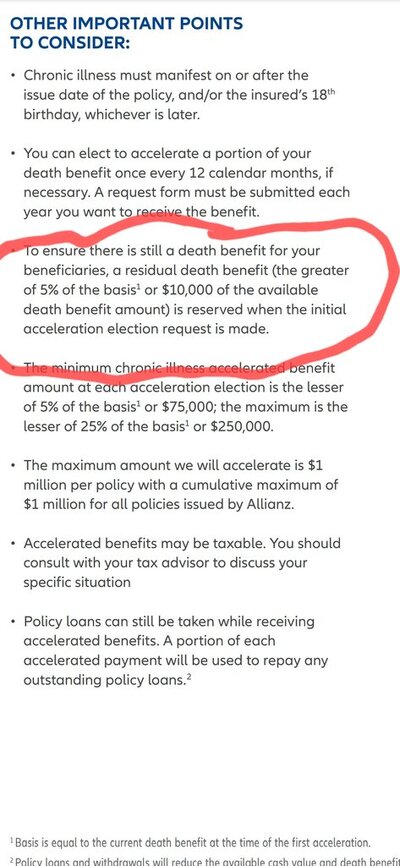

Also, when I mentioned to my insurance agent that I had done that with a small policy but they would not pay out the entire policy face under that rider, the agent told me Life Insurance Companies have to do that in order for the policy to be a Life Insurance Policy. If that is true, How then can David McKnight talk about being able to withdraw the entire policy face in four years under a policy LTC provision?

That seems to me to be a more efficacious solution than hoping that four years of life insurance withdrawals will be an adequate solution for a LTC need.

Also, when I mentioned to my insurance agent that I had done that with a small policy but they would not pay out the entire policy face under that rider, the agent told me Life Insurance Companies have to do that in order for the policy to be a Life Insurance Policy. If that is true, How then can David McKnight talk about being able to withdraw the entire policy face in four years under a policy LTC provision?

Last edited: