- 4,641

So I just got off with an actuary.

ALAN YOU ARE RIGHT!

He is going to send me a memo on the actual accounting for a situation like this and I will post it when I receive it.

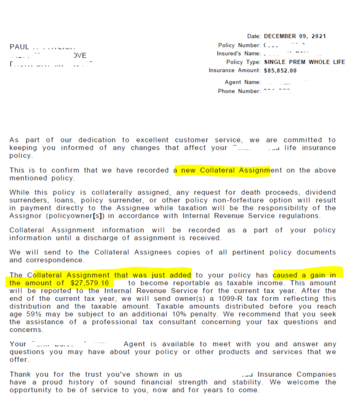

Whew---I thought I was, but wasnt sure. I just know I see a ton of bad moves by agents that were not aware of some of these issues (some are positive & some are negative). agents telling clients to use as collateral with bank or change ownership to hide money from x/y/z only to later find out they caused a potentially major tax problem in some of the policies with large gains. By time tax filing comes around in 4-16 months, it is too late for the client to undo the problem.

Some carriers have a letter that is sent after any item that triggers taxable event on MEC happens in case it needs to be reversed right away. (more common on the collateral assignment change than the loan/withdrawal)

many carreirs require an affirmative signature on all MECs(MEC notification form) at issue or when a policy becomes a MEC for this reason & the form states the 5 or 6 ways (loan/withdrawal/ bank collateral/ ownership change/multiple MECs issue in same year) problems can arise.

PS-- you might want to let the Advanced Planning ex- IRS rep know he should clarify his answer that "it isnt a taxable event if there is no gain"--sure, no tax notice going out now, but it might impact the policies calculation of the cost basis/ taxable gain when it is all figured out later & loan repaid or not. each year loan interest is compounding on the loan, it is impacting the taxable gain calculation as it counts against the client even if policy shrinking to zero. it is the sole reason for carriers trying to have the overloan protection

I am not naive to think all small carriers are properly calculating taxable gains in these unique situations nor do I think some may be trying to look the other way, but external auditing could cause issues if they are not tracking cost basis/taxable gain correctly

Last edited: