Lloyds of Lubbock

Guru

- 802

If the loan you took helped you or somebody else, enhanced your life, let you take advantage of a unique oppurtunity...it was a good deal period!

Whether you paid 5-6-7 % your life would be just as it is now.

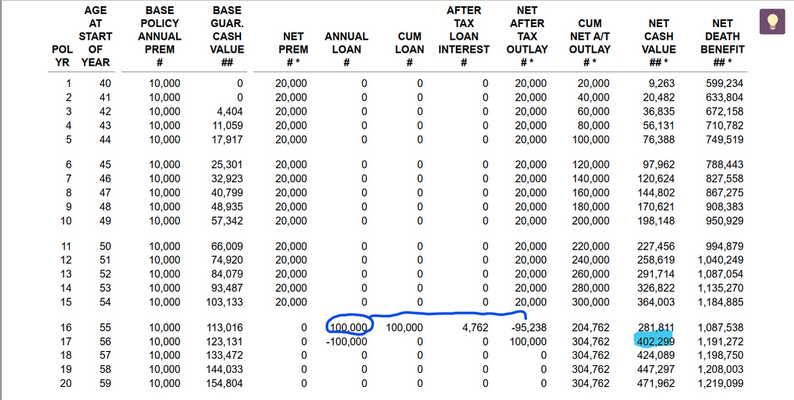

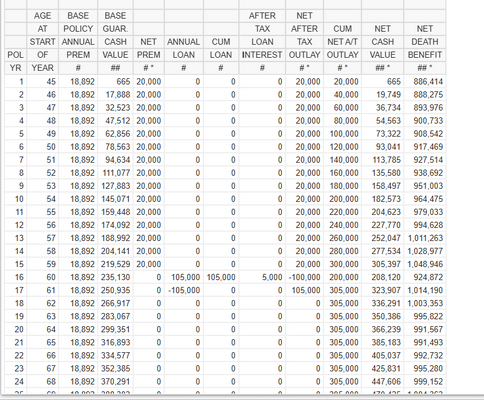

You bought a whole life policy and created a bucket of money for yourself which you used when you needed it.

No application

No credit check

No scrutiny from your CPA

No dinge on your credit report.

Be happy!

Picture from my terrace and hotel from last week

Whether you paid 5-6-7 % your life would be just as it is now.

You bought a whole life policy and created a bucket of money for yourself which you used when you needed it.

No application

No credit check

No scrutiny from your CPA

No dinge on your credit report.

Be happy!

Picture from my terrace and hotel from last week