- Thread starter

- #11

Lloyds of Lubbock

Guru

- 802

NY Life held.

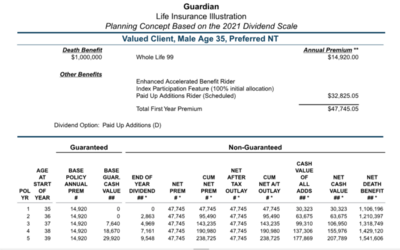

I suspect Guardian will hold .

They just released their new 7702 ten pay.

If they were going to change I would think they would make the change the unveil the new product.

But.....they did not ask for my opinion.

Happy Thanksgiving to all!

I suspect Guardian will hold .

They just released their new 7702 ten pay.

If they were going to change I would think they would make the change the unveil the new product.

But.....they did not ask for my opinion.

Happy Thanksgiving to all!