- 2,370

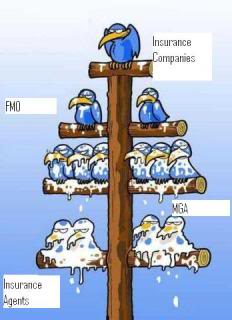

It really depends on what you expect out of the FMO.

Think of all the agents a large FMO deals with, from contracting issues, supplies, etc. Most carriers are happy to let them to through a FMO rather than call direct.

There are some great FMO's out there that can help with cases, training, getting volume discounts for leads (mailers and internet), guidance, etc. It is just a matter of finding them.

I look at FMO's like auto dealerships. If you want a new Ford, you cannot go to the factory and buy one, you have to go to a dealership. There may be numerous dealerships that have the exact Ford you are looking for, it is just a matter of finding one you want to do business with.

Think of all the agents a large FMO deals with, from contracting issues, supplies, etc. Most carriers are happy to let them to through a FMO rather than call direct.

There are some great FMO's out there that can help with cases, training, getting volume discounts for leads (mailers and internet), guidance, etc. It is just a matter of finding them.

I look at FMO's like auto dealerships. If you want a new Ford, you cannot go to the factory and buy one, you have to go to a dealership. There may be numerous dealerships that have the exact Ford you are looking for, it is just a matter of finding one you want to do business with.