Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

CUL - Dental Vision Health - Selling Experience?

- Thread starter MSN

- Start date

So you have both? UHC and CUL?

I do. Mostly to see how the CUL plan works.

I am really having a hard time understanding the great appeal of the Dental Plans considering the benefit limitations. However, juts had another IMO claim they are writing tons of it.

I’ve said it several times that it helps me woth actually getting my teeth cleaned every 6 months. Where I otherwise might not go and spend the money. But I have had fillings, 1 crown and one root canal.

- 6,493

When you were still selling the UHC plan, did you also sell the Vision Plan?

When you were still selling the UHC plan, did you also sell the Vision Plan?

I mean it’s a click of the button to add vision. I think the only UHC dental I sold was an add on to an under 65 health plan.

- 6,493

I do. Mostly to see how the CUL plan works.

I am little confused in relation to your earlier post about the CUL payment. Did they just take the dental bill you gave them and apply the current year percentage payment, or did they make other deductions too?

Thanks.

- 6,493

Ok, thanks. I was going to ask if you had any comments about the vision plan if you had sold any. I think your comment sorta explains your lack of enthusiasm for selling those plans!I mean it’s a click of the button to add vision. I think the only UHC dental I sold was an add on to an under 65 health plan.

I am little confused in relation to your earlier post about the CUL payment. Did they just take the dental bill you gave them and apply the current year percentage payment, or did they make other deductions too?

Thanks.

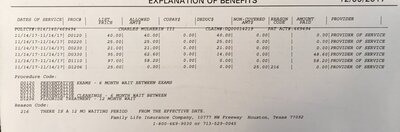

Looks like they applied the deductible and paid the %. They didn’t cover fluoride because it’s a 12 month wait. Look here

Attachments

IMO claim they are writing tons of it.

Claiming it doesn't make it so.

Beyond that, there are a lot of agents & agencies that are policy peddlers. Anything for a buck. Doesn't have to be good for the client as long as the agent can add to their own bank account.

Many of the policy mills crank out high volume sales but have low retention of agents and policyholders alike.

Churning agents and policies can be profitable if you do enough volume.

Supposedly it was the product that had the most increase among all the voluntary benefits in the last year. Must the money being made somewhere, every time you turn around a new player has jumped into the market.Claiming it doesn't make it so.

Beyond that, there are a lot of agents & agencies that are policy peddlers. Anything for a buck. Doesn't have to be good for the client as long as the agent can add to their own bank account.

Many of the policy mills crank out high volume sales but have low retention of agents and policyholders alike.

Churning agents and policies can be profitable if you do enough volume.

Similar threads

- Replies

- 1

- Views

- 886

- Replies

- 9

- Views

- 2K