- Thread starter

- #11

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

T65 Common Questions

- Thread starter m90180

- Start date

- 7,495

I think Dayton (DS4) posted on 12 years ago when he turned 65

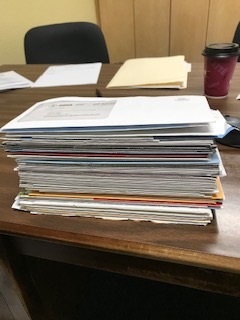

I wasn't around 12 years ago, but I do remember someone posting a stack of mail, I am sure it was sometime in the last 5 years, I went independent in 2011 but didn't really connect till 2014, When I expanded out of the NY.FL,CA States and started really learning about underwriting

- Thread starter

- #17

- 31,567

Bitte.Danke

..I was T65 in June 2017

Pretty close to 12 years ago

I don't know if these are germane to what you want to do, but

Medicare is not managed by Social Security, even though you have to apply there.

Medicare eligibility age is no longer the same as Social Security full retirement age.

Forms for delayed part B application.

I see even some agents on the site being confused about the time frames for the Part B and Med Sup enrollments when Part B is delayed due to employment.

Part A and HSA

Part B and Part D penalty free enrollment time frames coming off working past 65 are different. I was misinformed about this by a national med sup sales person and narrowly avoided having a (small) part D penalty as a result.

What does and does not (employer type coverages) count as creditable Part D coverage.

Part A (esp. when there's a chance of retro coverage) and HSA is a good topic.

What does and does not (employer type coverages) count as creditable Part D coverage. -- This one doesn't make sense to me. It's not like employers offer "type" X, Y, Z and only Z is creditable. When people enroll into benefits, they should be mindful about which plans are creditable or not. And for those 65 or older they should be getting a separate notice from their employer as to whether or not the drug coverage is creditable.

You might be confusing what kind of employer (active vs retiree) is creditable for Part B enrollment?

Similar threads

- Replies

- 3

- Views

- 384

- Replies

- 7

- Views

- 486

- Replies

- 21

- Views

- 1K