A new study finds more than 4 in 10 intermediaries—brokerage general agencies (BGAs) and independent marketing organizations (IMOs)—already have or plan to establish programs to recruit more women financial professionals into their network.

In the third annual study, “Inside the Intermediary 3.0: A LIMRA-NAILBA Study — BGA and IMO Survey Results,” almost half of the intermediaries (46%) said they either had programs to support female financial professionals or plan to add one within the next year.

These efforts are to bolster the number of women in the ranks. Today, just 18% of financial professionals in intermediary networks are women. This is important because prior LIMRA research shows 44% of consumers say a financial professional’s gender is important.

When asked what’s behind their gender preference, consumers—particularly those who prefer a female financial professional—often describe soft skills (60%) that they associate with women.

Gen Z women (35%) and members of the LGBTQ+ community (27%) are more likely than others to prefer working with a female financial professional. As Gen Z consumers age and look for financial advice, having female financial professionals will be critical to sales growth.

Intermediaries’ top priority: Growing their network

Sixty-five percent of intermediaries expect their producer network to grow in the next three years. Expanding their efforts to recruit and support women financial professionals advances their top priority of growing their network of producers.

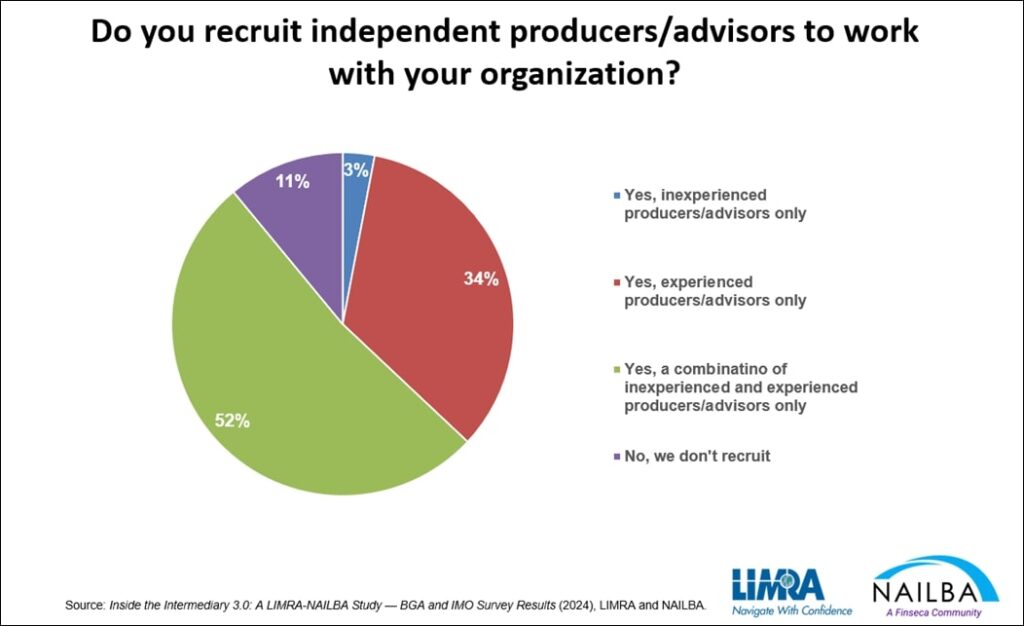

More than half of the intermediaries (52%) see this growth coming from recruiting a mix of experienced and inexperienced professionals. There is also an effort to support financial professionals once hired. Seventy-eight percent of intermediaries offer tailored training based on the experience level of recruited producers.

“Continuing to recruit new and experienced financial professionals and providing innovative services will help the industry meet the changing needs of consumers,” said Bryan Hodgens, head of LIMRA research.

Sixty percent of intermediaries expect revenues from financial planning/wealth management products and services to increase 10% or more over the next three years.

“In a relatively short period of time, BGAs and IMOs have become the largest life insurance producer channel in the United States. As such, their growth and productivity have become critically important in helping Americans get the financial guidance they need to protect the ones they love,” said Dan LaBert, president of Independent Distribution, NAILBA.

Looking ahead over the next three years, the IMOs and BGAs see the fastest growing products as life insurance (cited by 45%), followed by annuities (26%) and long-term care (17%). Forty-two percent of intermediaries have experienced an increase in life insurance production over the past two years.

When it comes to services to be offered, the intermediaries see the highest growth potential in estate and trust services (26%), retirement-income planning (22%) and insurance planning (18%).

As the U.S. demographics continues to evolve and change, it is important for the industry to keep pace. By recruiting experienced and inexperienced producers—including women—and providing innovative financial solutions, intermediaries can continue to meet consumers’ changing needs.