- 5,319

Hi guys,

I am writing this forum post to assist newer agents in the process of discovering how they can avoid the common contractual pitfalls associated with many final expense marketing organizations.

NOTE: For agents browsing the Insurance Forum for advice on which organization to join, thankfully the vast majority of agencies recruiting on the Forum do NOT do any of these shady contracting scams.

The great thing about the Insurance Forum is that we all hold each other accountable for any BS, which raises the bar for all competing recruiting organizations, so much so that if any pulled the kind of "stunts" mentioned below, they'd be chased off and never return.

...The Free Market At Work!

Plus, most (if not all) own are associated with great final expense agency organizations, and have the field experience necessary to train new agents into a position of success.

The reason you should be wary of final expense contracting shadiness is that many of the heavy recruiting organizations utilize these scams as contractual shackles, preventing you from maximizing your income, effectively imprisoning you in an organization that may turn out nothing like you expected.

That's why it's important to ask the tough questions upfront.

Understand that most final expense marketing organizations are experts at presenting themselves in a positive light. There salespeople, after all!

However, sometimes there ain't much steak to the sizzle. And getting these important issues answered up front will help you tremendously in your longevity in the business.

1st Contract Scam: Limited Vesting Of Your Book Of Business

One thing you must understand about selling insurance. Your prospects don't buy companies...

...They buy YOU.

The carriers you offer them are a secondary matter. Your trust, rapport, and relationship built with your client is the most important aspect of your success in this business.

This is why it is imperative you must OWN the business you write!

Here's what I mean.

"Vesting" refers to the point at which you actually OWN your book of business you wrote. Further, this is defined as who owns the future commission streams.

As an independent agent, generally-speaking, you own your future commissions 100% from the first day. This means if you part ways with your insurance agency, they do not take ownership of your clients' commission streams.

Seems fair, right? But here's the thing… MANY captive agencies specifically set a one- or two-year period in which, if you are terminated (for cause, or NOT for cause - more on that later), the clients YOU sold, that YOU service, become the property of your upline manager, INCLUDING the commission streams!

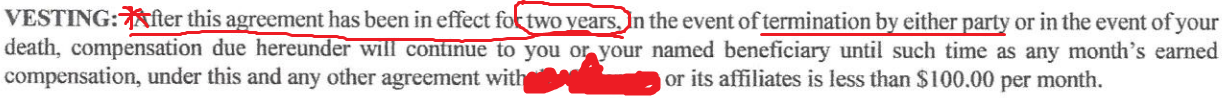

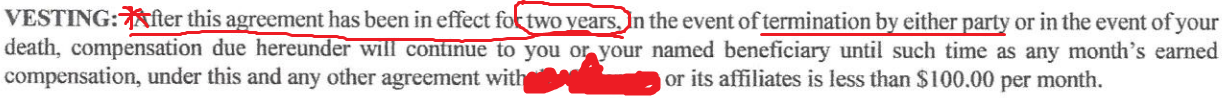

Take a look at the sample agent contract below. I snipped this portion out where you can see for yourself what one large final expense organization does to take ownership of your block of business:

Bottom line, this problem is REAL. And luckily, is avoidable… IF you find the RIGHT final expense organization to join (like virtually ALL of the final expense organizations on the Insurance Forum).

2nd Contract Scam: Captivity To One Carrier

Ask any experienced final expense agent. They will tell you that selling final expense is akin to running your own business.

YOU must motivate yourself to sell. YOU must be responsible for learning new sales skills and improving your game. YOU carry the full brunt of taxation, just as a business owner does.

Therefore, does it not make sense to have the POSITIVE aspects of business ownership including, too? Such as freedom to work HOW you want… and with WHOM you want to work with?

This is the problem with captive agencies.

They FORCE you to do business with them AND ONLY THEM.

Contractually, many times they will make you ask them permission to work with other final expense companies. And many times, they will TERMINATE you (and probably take your unvested commissions, too!) if you do so without their permission!

There's several problems with this setup.

Number one, you're obviously in business for yourself. You should have the freedom to do what you want.

Number two is the nature in which a captive final expense organization operates.

You are CAPTIVE to one company. You are captive to ONE product!

And no final expense product is perfect for all your clients!

What incidentally happens to captive agents is that their quality of business is at higher risk of being poor. For example, captive agents experience replacements more often, lower closing ratios, and approving clients for poorer quality coverage.

What's the alternative? Be an independent agent!

Independent agents work with whom they want. Independent agents can shop the best final expense carriers for their clients. And many times, the overall quality of business is MUCH better. Less replacements, better pricing, and better quality of coverage.

Luckily, most final expense agencies on the Forum are independent with a wide array of final expense carriers available.

Scam #3: Release Provisions

While many marketing organizations sound great initially, relationships may sour, and opinions may change, so much so that working with another organization may be a better direction for your final expense career.

That's why you need to ensure your final expense agency will release you to the organization of your choice, if YOU deem it necessary.

You see, your final expense agency has total power over whether or not he wants you released from the final expense carrier contract.

Sometimes there is good reason for this. There are agents that load up charge backs and leave the debt to the agency. And the agency needs leverage to ensure said debt is cleared.

I personally understand that as a final expense agency myself, and think this is a fair reason why an agent may not be released immediately upon request.

However, if the agent is debt free to his final expense agency, has good quality business, and doesn't have any other financial obligations to his existing final expense agency, there really is no reason why you cannot request and receive a release to whatever final expense marketing organization you select.

NOTE: If you are stuck with an agency that will NOT release, even if you satisfy all the points above, in most cases, you'll essentially be a "free agent" after six months of non-production. So, as much as it stinks, shelve that final expense carrier, wait six months, then you should be able to move your carrier business to whomever you please.

#4 Scam: Termination Considerations

Termination considerations tie in directly with the vesting language found in the most onerous final expense agent contracts.

There are two types of terminations.

First is for-cause. This is when you're terminated to violating your agent contract.

The second is non-cause termination. You are effectively appointed "at-will," and most final expense contracts state either party can terminate the contract at any time.

The problem with termination when stuck in a non-vested agent contract is that you will lose your future commissions whether or not you are terminated for-cause or not-for-cause.

Basically, you put your business earnings in total control to your captive agency.

I once had an agent who was terminated not-for-cause (didn't get along with his managers), that if terminated one week prior, he would have lost approximately $30,000 in future commissions over the next year.

In fact, said agency attempted to date the termination letter a DAY before his two year vesting agreement took effect, even though he received the termination letter 10 days AFTER the date on the termination notice!

Luckily, the agent contract stated the vesting provision was based on the date received by the agent, and NOT due to an arbitrary date, made up by his agency. That agent definitely lucked out!

Conclusion

FInal expense is a great business. Just make sure you work in a capacity that you OWN your business, AND retain the freedom that comes with it, too.

Ignorance of the points made above has cost hundreds of final expense agents untold amounts of commission and heartache, with many (if not most) leaving the business altogether with a bad taste in their mouths.

Hope you found this training useful and informative. Make sure you put it to good use!

-Dave

I am writing this forum post to assist newer agents in the process of discovering how they can avoid the common contractual pitfalls associated with many final expense marketing organizations.

NOTE: For agents browsing the Insurance Forum for advice on which organization to join, thankfully the vast majority of agencies recruiting on the Forum do NOT do any of these shady contracting scams.

The great thing about the Insurance Forum is that we all hold each other accountable for any BS, which raises the bar for all competing recruiting organizations, so much so that if any pulled the kind of "stunts" mentioned below, they'd be chased off and never return.

...The Free Market At Work!

Plus, most (if not all) own are associated with great final expense agency organizations, and have the field experience necessary to train new agents into a position of success.

The reason you should be wary of final expense contracting shadiness is that many of the heavy recruiting organizations utilize these scams as contractual shackles, preventing you from maximizing your income, effectively imprisoning you in an organization that may turn out nothing like you expected.

That's why it's important to ask the tough questions upfront.

Understand that most final expense marketing organizations are experts at presenting themselves in a positive light. There salespeople, after all!

However, sometimes there ain't much steak to the sizzle. And getting these important issues answered up front will help you tremendously in your longevity in the business.

1st Contract Scam: Limited Vesting Of Your Book Of Business

One thing you must understand about selling insurance. Your prospects don't buy companies...

...They buy YOU.

The carriers you offer them are a secondary matter. Your trust, rapport, and relationship built with your client is the most important aspect of your success in this business.

This is why it is imperative you must OWN the business you write!

Here's what I mean.

"Vesting" refers to the point at which you actually OWN your book of business you wrote. Further, this is defined as who owns the future commission streams.

As an independent agent, generally-speaking, you own your future commissions 100% from the first day. This means if you part ways with your insurance agency, they do not take ownership of your clients' commission streams.

Seems fair, right? But here's the thing… MANY captive agencies specifically set a one- or two-year period in which, if you are terminated (for cause, or NOT for cause - more on that later), the clients YOU sold, that YOU service, become the property of your upline manager, INCLUDING the commission streams!

Take a look at the sample agent contract below. I snipped this portion out where you can see for yourself what one large final expense organization does to take ownership of your block of business:

Bottom line, this problem is REAL. And luckily, is avoidable… IF you find the RIGHT final expense organization to join (like virtually ALL of the final expense organizations on the Insurance Forum).

2nd Contract Scam: Captivity To One Carrier

Ask any experienced final expense agent. They will tell you that selling final expense is akin to running your own business.

YOU must motivate yourself to sell. YOU must be responsible for learning new sales skills and improving your game. YOU carry the full brunt of taxation, just as a business owner does.

Therefore, does it not make sense to have the POSITIVE aspects of business ownership including, too? Such as freedom to work HOW you want… and with WHOM you want to work with?

This is the problem with captive agencies.

They FORCE you to do business with them AND ONLY THEM.

Contractually, many times they will make you ask them permission to work with other final expense companies. And many times, they will TERMINATE you (and probably take your unvested commissions, too!) if you do so without their permission!

There's several problems with this setup.

Number one, you're obviously in business for yourself. You should have the freedom to do what you want.

Number two is the nature in which a captive final expense organization operates.

You are CAPTIVE to one company. You are captive to ONE product!

And no final expense product is perfect for all your clients!

What incidentally happens to captive agents is that their quality of business is at higher risk of being poor. For example, captive agents experience replacements more often, lower closing ratios, and approving clients for poorer quality coverage.

What's the alternative? Be an independent agent!

Independent agents work with whom they want. Independent agents can shop the best final expense carriers for their clients. And many times, the overall quality of business is MUCH better. Less replacements, better pricing, and better quality of coverage.

Luckily, most final expense agencies on the Forum are independent with a wide array of final expense carriers available.

Scam #3: Release Provisions

While many marketing organizations sound great initially, relationships may sour, and opinions may change, so much so that working with another organization may be a better direction for your final expense career.

That's why you need to ensure your final expense agency will release you to the organization of your choice, if YOU deem it necessary.

You see, your final expense agency has total power over whether or not he wants you released from the final expense carrier contract.

Sometimes there is good reason for this. There are agents that load up charge backs and leave the debt to the agency. And the agency needs leverage to ensure said debt is cleared.

I personally understand that as a final expense agency myself, and think this is a fair reason why an agent may not be released immediately upon request.

However, if the agent is debt free to his final expense agency, has good quality business, and doesn't have any other financial obligations to his existing final expense agency, there really is no reason why you cannot request and receive a release to whatever final expense marketing organization you select.

NOTE: If you are stuck with an agency that will NOT release, even if you satisfy all the points above, in most cases, you'll essentially be a "free agent" after six months of non-production. So, as much as it stinks, shelve that final expense carrier, wait six months, then you should be able to move your carrier business to whomever you please.

#4 Scam: Termination Considerations

Termination considerations tie in directly with the vesting language found in the most onerous final expense agent contracts.

There are two types of terminations.

First is for-cause. This is when you're terminated to violating your agent contract.

The second is non-cause termination. You are effectively appointed "at-will," and most final expense contracts state either party can terminate the contract at any time.

The problem with termination when stuck in a non-vested agent contract is that you will lose your future commissions whether or not you are terminated for-cause or not-for-cause.

Basically, you put your business earnings in total control to your captive agency.

I once had an agent who was terminated not-for-cause (didn't get along with his managers), that if terminated one week prior, he would have lost approximately $30,000 in future commissions over the next year.

In fact, said agency attempted to date the termination letter a DAY before his two year vesting agreement took effect, even though he received the termination letter 10 days AFTER the date on the termination notice!

Luckily, the agent contract stated the vesting provision was based on the date received by the agent, and NOT due to an arbitrary date, made up by his agency. That agent definitely lucked out!

Conclusion

FInal expense is a great business. Just make sure you work in a capacity that you OWN your business, AND retain the freedom that comes with it, too.

Ignorance of the points made above has cost hundreds of final expense agents untold amounts of commission and heartache, with many (if not most) leaving the business altogether with a bad taste in their mouths.

Hope you found this training useful and informative. Make sure you put it to good use!

-Dave