- 27,051

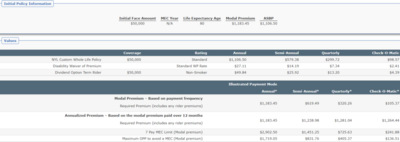

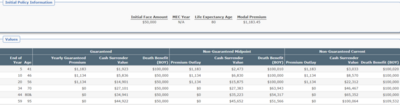

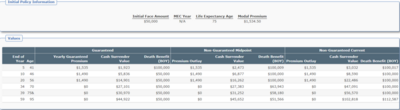

It will be interesting to see the illustrations.

If it winds up a T10 participating WL with a Guaranteed DB but stripped out CV it turns into a something resembling a Gul. No? Sounds like a no brainer to take it.

Maybe ask if the client can request more with the same underwriting limit. Probably going the best he can get going forward. That would be a win for the client and agent.

IMohsoHO

If it winds up a T10 participating WL with a Guaranteed DB but stripped out CV it turns into a something resembling a Gul. No? Sounds like a no brainer to take it.

Maybe ask if the client can request more with the same underwriting limit. Probably going the best he can get going forward. That would be a win for the client and agent.

IMohsoHO