- Thread starter

- #11

nOT A REAL NAME

New Member

- 7

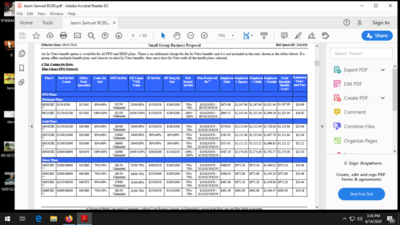

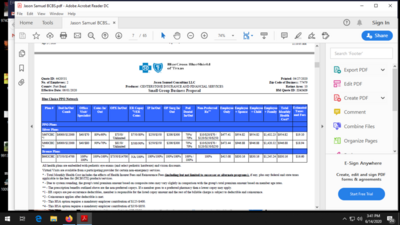

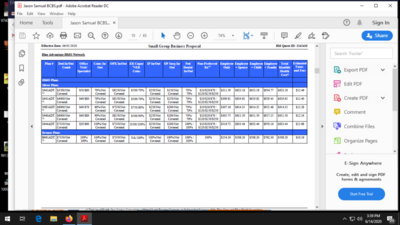

@STIBROKER Thanks for the advice. I was talking with some other people, and it seems you're right. However it seems like they updated some of their plans. I'm gonna see if I can review their plans especially the one over disasters like cancer. Then come back here